Breakthrough therapies are breaking patients' banks. Key changes could improve access, experts say.

Single-treatment therapies are revolutionizing medicine. But insurers and patients wonder whether they can afford treatment and, if they can, whether the high costs are worthwhile.

CSL Behring’s new gene therapy for hemophilia, Hemgenix, costs $3.5 million for one treatment, but helps the body create substances that allow blood to clot. It appears to be a cure, eliminating the need for other treatments for many years at least.

Likewise, Novartis’s Kymriah mobilizes the body’s immune system to fight B-cell lymphoma, but at a cost $475,000. For patients who respond, it seems to offer years of life without the cancer progressing.

These single-treatment therapies are at the forefront of a new, bold era of medicine. Unfortunately, they also come with new, bold prices that leave insurers and patients wondering whether they can afford treatment and, if they can, whether the high costs are worthwhile.

“Most pharmaceutical leaders are there to improve and save people’s lives,” says Jeremy Levin, chairman and CEO of Ovid Therapeutics, and immediate past chairman of the Biotechnology Innovation Organization. If the therapeutics they develop are too expensive for payers to authorize, patients aren’t helped.

“The right to receive care and the right of pharmaceuticals developers to profit should never be at odds,” Levin stresses. And yet, sometimes they are.

Leigh Turner, executive director of the bioethics program, University of California, Irvine, notes this same tension between drug developers that are “seeking to maximize profits by charging as much as the market will bear for cell and gene therapy products and other medical interventions, and payers trying to control costs while also attempting to provide access to medical products with promising safety and efficacy profiles.”

Why Payers Balk

Health insurers can become skittish around extremely high prices, yet these therapies often accompany significant overall savings. For perspective, the estimated annual treatment cost for hemophilia exceeds $300,000. With Hemgenix, payers would break even after about 12 years.

But, in 12 years, will the patient still have that insurer? Therein lies the rub. U.S. payers, are used to a “pay-as-you-go” model, in which the lifetime costs of therapies typically are shared by multiple payers over many years, as patients change jobs. Single treatment therapeutics eliminate that cost-sharing ability.

"As long as formularies are based on profits to middlemen…Americans’ healthcare costs will continue to skyrocket,” says Patricia Goldsmith, the CEO of CancerCare.

“There is a phenomenally complex, bureaucratic reimbursement system that has grown, layer upon layer, during several decades,” Levin says. As medicine has innovated, payment systems haven’t kept up.

Therefore, biopharma companies begin working with insurance companies and their pharmacy benefit managers (PBMs), which act on an insurer’s behalf to decide which drugs to cover and by how much, early in the drug approval process. Their goal is to make sophisticated new drugs available while still earning a return on their investment.

New Payment Models

Pay-for-performance is one increasingly popular strategy, Turner says. “These models typically link payments to evidence generation and clinically significant outcomes.”

A biotech company called bluebird bio, for example, offers value-based pricing for Zynteglo, a $2.8 million possible cure for the rare blood disorder known as beta thalassaemia. It generally eliminates patients’ need for blood transfusions. The company is so sure it works that it will refund 80 percent of the cost of the therapy if patients need blood transfusions related to that condition within five years of being treated with Zynteglo.

In his February 2023 State of the Union speech, President Biden proposed three pilot programs to reduce drug costs. One of them, the Cell and Gene Therapy Access Model calls on the federal Centers for Medicare & Medicaid Services to establish outcomes-based agreements with manufacturers for certain cell and gene therapies.

A mortgage-style payment system is another, albeit rare, approach. Amortized payments spread the cost of treatments over decades, and let people change employers without losing their healthcare benefits.

Only about 14 percent of all drugs that enter clinical trials are approved by the FDA. Pharma companies, therefore, have an exigent need to earn a profit.

The new payment models that are being discussed aren’t solutions to high prices, says Bill Kramer, senior advisor for health policy at Purchaser Business Group on Health (PBGH), a nonprofit that seeks to lower health care costs. He points out that innovative pricing models, although well-intended, may distract from the real problem of high prices. They are attempts to “soften the blow. The best thing would be to charge a reasonable price to begin with,” he says.

Instead, he proposes making better use of research on cost and clinical effectiveness. The Institute for Clinical and Economic Review (ICER) conducts such research in the U.S., determining whether the benefits of specific drugs justify their proposed prices. ICER is an independent non-profit research institute. Its reports typically assess the degrees of improvement new therapies offer and suggest prices that would reflect that. “Publicizing that data is very important,” Kramer says. “Their results aren’t used to the extent they could and should be.” Pharmaceutical companies tend to price their therapies higher than ICER’s recommendations.

Drug Development Costs Soar

Drug developers have long pointed to the onerous costs of drug development as a reason for high prices.

A 2020 study found the average cost to bring a drug to market exceeded $1.1 billion, while other studies have estimated overall costs as high as $2.6 billion. The development timeframe is about 10 years. That’s because modern therapeutics target precise mechanisms to create better outcomes, but also have high failure rates. Only about 14 percent of all drugs that enter clinical trials are approved by the FDA. Pharma companies, therefore, have an exigent need to earn a profit.

Skewed Incentives Increase Costs

Pricing isn’t solely at the discretion of pharma companies, though. “What patients end up paying has much more to do with their PBMs than the actual price of the drug,” Patricia Goldsmith, CEO, CancerCare, says. Transparency is vital.

PBMs control patients’ access to therapies at three levels, through price negotiations, pricing tiers and pharmacy management.

When negotiating with drug manufacturers, Goldsmith says, “PBMs exchange a preferred spot on a formulary (the insurer’s or healthcare provider’s list of acceptable drugs) for cash-base rebates.” Unfortunately, 25 percent of the time, those rebates are not passed to insurers, according to the PBGH report.

Then, PBMs use pricing tiers to steer patients and physicians to certain drugs. For example, Kramer says, “Sometimes PBMs put a high-cost brand name drug in a preferred tier and a lower-cost competitor in a less preferred, higher-cost tier.” As the PBGH report elaborates, “(PBMs) are incentivized to include the highest-priced drugs…since both manufacturing rebates, as well as the administrative fees they charge…are calculated as a percentage of the drug’s price.

Finally, by steering patients to certain pharmacies, PBMs coordinate patients’ access to treatments, control patients’ out-of-pocket costs and receive management fees from the pharmacies.

Therefore, Goldsmith says, “As long as formularies are based on profits to middlemen…Americans’ healthcare costs will continue to skyrocket.”

Transparency into drug pricing will help curb costs, as will new payment strategies. What will make the most impact, however, may well be the development of a new reimbursement system designed to handle dramatic, breakthrough drugs. As Kramer says, “We need a better system to identify drugs that offer dramatic improvements in clinical care.”

Scientists turn pee into power in Uganda

With conventional fuel cells as their model, researchers learned to use similar chemical reactions to make a fuel from microbes in pee.

At the edge of a dirt road flanked by trees and green mountains outside the town of Kisoro, Uganda, sits the concrete building that houses Sesame Girls School, where girls aged 11 to 19 can live, learn and, at least for a while, safely use a toilet. In many developing regions, toileting at night is especially dangerous for children. Without electrical power for lighting, kids may fall into the deep pits of the latrines through broken or unsteady floorboards. Girls are sometimes assaulted by men who hide in the dark.

For the Sesame School girls, though, bright LED lights, connected to tiny gadgets, chased the fears away. They got to use new, clean toilets lit by the power of their own pee. Some girls even used the light provided by the latrines to study.

Urine, whether animal or human, is more than waste. It’s a cheap and abundant resource. Each day across the globe, 8.1 billion humans make 4 billion gallons of pee. Cows, pigs, deer, elephants and other animals add more. By spending money to get rid of it, we waste a renewable resource that can serve more than one purpose. Microorganisms that feed on nutrients in urine can be used in a microbial fuel cell that generates electricity – or "pee power," as the Sesame girls called it.

Plus, urine contains water, phosphorus, potassium and nitrogen, the key ingredients plants need to grow and survive. Human urine could replace about 25 percent of current nitrogen and phosphorous fertilizers worldwide and could save water for gardens and crops. The average U.S. resident flushes a toilet bowl containing only pee and paper about six to seven times a day, which adds up to about 3,500 gallons of water down per year. Plus cows in the U.S. produce 231 gallons of the stuff each year.

Pee power

A conventional fuel cell uses chemical reactions to produce energy, as electrons move from one electrode to another to power a lightbulb or phone. Ioannis Ieropoulos, a professor and chair of Environmental Engineering at the University of Southampton in England, realized the same type of reaction could be used to make a fuel from microbes in pee.

Bacterial species like Shewanella oneidensis and Pseudomonas aeruginosa can consume carbon and other nutrients in urine and pop out electrons as a result of their digestion. In a microbial fuel cell, one electrode is covered in microbes, immersed in urine and kept away from oxygen. Another electrode is in contact with oxygen. When the microbes feed on nutrients, they produce the electrons that flow through the circuit from one electrod to another to combine with oxygen on the other side. As long as the microbes have fresh pee to chomp on, electrons keep flowing. And after the microbes are done with the pee, it can be used as fertilizer.

These microbes are easily found in wastewater treatment plants, ponds, lakes, rivers or soil. Keeping them alive is the easy part, says Ieropoulos. Once the cells start producing stable power, his group sequences the microbes and keeps using them.

Like many promising technologies, scaling these devices for mass consumption won’t be easy, says Kevin Orner, a civil engineering professor at West Virginia University. But it’s moving in the right direction. Ieropoulos’s device has shrunk from the size of about three packs of cards to a large glue stick. It looks and works much like a AAA battery and produce about the same power. By itself, the device can barely power a light bulb, but when stacked together, they can do much more—just like photovoltaic cells in solar panels. His lab has produced 1760 fuel cells stacked together, and with manufacturing support, there’s no theoretical ceiling, he says.

Although pure urine produces the most power, Ieropoulos’s devices also work with the mixed liquids of the wastewater treatment plants, so they can be retrofit into urban wastewater utilities.

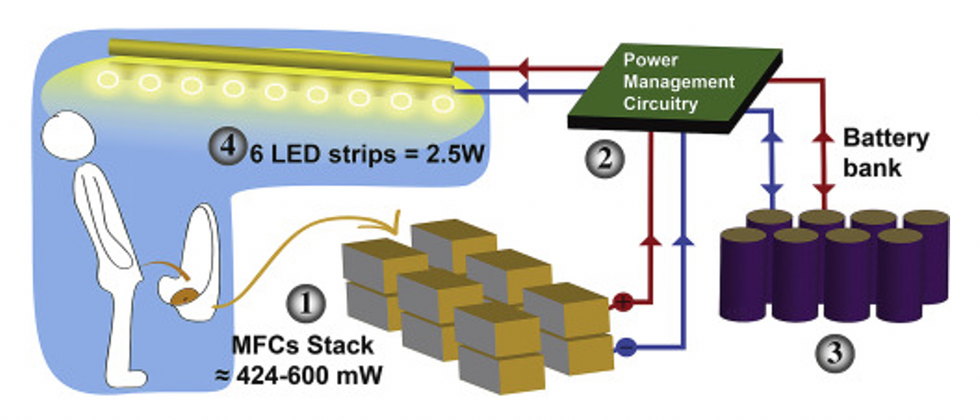

This image shows how the pee-powered system works. Pee feeds bacteria in the stack of fuel cells (1), which give off electrons (2) stored in parallel cylindrical cells (3). These cells are connected to a voltage regulator (4), which smooths out the electrical signal to ensure consistent power to the LED strips lighting the toilet.

Courtesy Ioannis Ieropoulos

Key to the long-term success of any urine reclamation effort, says Orner, is avoiding what he calls “parachute engineering”—when well-meaning scientists solve a problem with novel tech and then abandon it. “The way around that is to have either the need come from the community or to have an organization in a community that is committed to seeing a project operate and maintained,” he says.

Success with urine reclamation also depends on the economy. “If energy prices are low, it may not make sense to recover energy,” says Orner. “But right now, fertilizer prices worldwide are generally pretty high, so it may make sense to recover fertilizer and nutrients.” There are obstacles, too, such as few incentives for builders to incorporate urine recycling into new construction. And any hiccups like leaks or waste seepage will cost builders money and reputation. Right now, Orner says, the risks are just too high.

Despite the challenges, Ieropoulos envisions a future in which urine is passed through microbial fuel cells at wastewater treatment plants, retrofitted septic tanks, and building basements, and is then delivered to businesses to use as agricultural fertilizers. Although pure urine produces the most power, Ieropoulos’s devices also work with the mixed liquids of the wastewater treatment plants, so they can be retrofitted into urban wastewater utilities where they can make electricity from the effluent. And unlike solar cells, which are a common target of theft in some areas, nobody wants to steal a bunch of pee.

When Ieropoulos’s team returned to wrap up their pilot project 18 months later, the school’s director begged them to leave the fuel cells in place—because they made a major difference in students’ lives. “We replaced it with a substantial photovoltaic panel,” says Ieropoulos, They couldn’t leave the units forever, he explained, because of intellectual property reasons—their funders worried about theft of both the technology and the idea. But the photovoltaic replacement could be stolen, too, leaving the girls in the dark.

The story repeated itself at another school, in Nairobi, Kenya, as well as in an informal settlement in Durban, South Africa. Each time, Ieropoulos vowed to return. Though the pandemic has delayed his promise, he is resolute about continuing his work—it is a moral and legal obligation. “We've made a commitment to ourselves and to the pupils,” he says. “That's why we need to go back.”

Urine as fertilizer

Modern day industrial systems perpetuate the broken cycle of nutrients. When plants grow, they use up nutrients the soil. We eat the plans and excrete some of the nutrients we pass them into rivers and oceans. As a result, farmers must keep fertilizing the fields while our waste keeps fertilizing the waterways, where the algae, overfertilized with nitrogen, phosphorous and other nutrients grows out of control, sucking up oxygen that other marine species need to live. Few global communities remain untouched by the related challenges this broken chain create: insufficient clean water, food, and energy, and too much human and animal waste.

The Rich Earth Institute in Vermont runs a community-wide urine nutrient recovery program, which collects urine from homes and businesses, transports it for processing, and then supplies it as fertilizer to local farms.

One solution to this broken cycle is reclaiming urine and returning it back to the land. The Rich Earth Institute in Vermont is one of several organizations around the world working to divert and save urine for agricultural use. “The urine produced by an adult in one day contains enough fertilizer to grow all the wheat in one loaf of bread,” states their website.

Notably, while urine is not entirely sterile, it tends to harbor fewer pathogens than feces. That’s largely because urine has less organic matter and therefore less food for pathogens to feed on, but also because the urinary tract and the bladder have built-in antimicrobial defenses that kill many germs. In fact, the Rich Earth Institute says it’s safe to put your own urine onto crops grown for home consumption. Nonetheless, you’ll want to dilute it first because pee usually has too much nitrogen and can cause “fertilizer burn” if applied straight without dilution. Other projects to turn urine into fertilizer are in progress in Niger, South Africa, Kenya, Ethiopia, Sweden, Switzerland, The Netherlands, Australia, and France.

Eleven years ago, the Institute started a program that collects urine from homes and businesses, transports it for processing, and then supplies it as fertilizer to local farms. By 2021, the program included 180 donors producing over 12,000 gallons of urine each year. This urine is helping to fertilize hay fields at four partnering farms. Orner, the West Virginia professor, sees it as a success story. “They've shown how you can do this right--implementing it at a community level scale."

In this week's Friday Five, breathing this way may cut down on anxiety, a fasting regimen that could make you sick, this type of job makes men more virile, 3D printed hearts could save your life, and the role of metformin in preventing dementia.

The Friday Five covers five stories in research that you may have missed this week. There are plenty of controversies and troubling ethical issues in science – and we get into many of them in our online magazine – but this news roundup focuses on scientific creativity and progress to give you a therapeutic dose of inspiration headed into the weekend.

Here are the promising studies covered in this week's Friday Five, featuring interviews with Dr. David Spiegel, associate chair of psychiatry and behavioral sciences at Stanford, and Dr. Filip Swirski, professor of medicine and cardiology at the Icahn School of Medicine at Mount Sinai.

Listen on Apple | Listen on Spotify | Listen on Stitcher | Listen on Amazon | Listen on Google

Here are the promising studies covered in this week's Friday Five, featuring interviews with Dr. David Spiegel, associate chair of psychiatry and behavioral sciences at Stanford, and Dr. Filip Swirski, professor of medicine and cardiology at the Icahn School of Medicine at Mount Sinai.

- Breathing this way cuts down on anxiety*

- Could your fasting regimen make you sick?

- This type of job makes men more virile

- 3D printed hearts could save your life

- Yet another potential benefit of metformin

* This video with Dr. Andrew Huberman of Stanford shows exactly how to do the breathing practice.

This podcast originally aired on March 3, 2023.