Is China Winning the Innovation Race?

Flags of America and China illuminated by light bulbs with a question mark between them.

Over the past two millennia, Chinese ingenuity has spawned some of humanity's most consequential inventions. Without gunpowder, guns, bombs, and rockets; without paper, printing, and money printed on paper; and without the compass, which enabled ships to navigate the open ocean, modern civilization might never have been born.

Today, a specter is haunting the developed world: Chinese innovation dominance. And the results have been so spectacular that the United States feels its preeminence threatened.

Yet China lapsed into cultural and technological stagnation during the Qing dynasty, just as the Scientific Revolution was transforming Europe. Western colonial incursions and a series of failed rebellions further sapped the Celestial Empire's capacity for innovation. By the mid-20th century, when the Communist triumph led to a devastating famine and years of bloody political turmoil, practically the only intellectual property China could offer for export was Mao's Little Red Book.

After Deng Xiaoping took power in 1978, launching a transition from a rigidly planned economy to a semi-capitalist one, China's factories began pumping out goods for foreign consumption. Still, originality remained a low priority. The phrase "Made in China" came to be synonymous with "cheap knockoff."

Today, however, a specter is haunting the developed world: Chinese innovation dominance. It first wafted into view in 2006, when the government announced an "indigenous innovation" campaign, dedicated to establishing China as a technology powerhouse by 2020—and a global leader by 2050—as part of its Medium- and Long-Term National Plan for Science and Technology Development. Since then, an array of initiatives have sought to unleash what pundits often call the Chinese "tech dragon," whether in individual industries, such as semiconductors or artificial intelligence, or across the board (as with the Made in China 2025 project, inaugurated in 2015). These efforts draw on a well-stocked bureaucratic arsenal: state-directed financing; strategic mergers and acquisitions; competition policies designed to boost domestic companies and hobble foreign rivals; buy-Chinese procurement policies; cash incentives for companies to file patents; subsidies for academic researchers in favored fields.

The results have been spectacular—so much so that the United States feels its preeminence threatened. Voices across the political spectrum are calling for emergency measures, including a clampdown on technology transfers, capital investment, and Chinese students' ability to study abroad. But are the fears driving such proposals justified?

"We've flipped from thinking China is incapable of anything but imitation to thinking China is about to eat our lunch," says Kaiser Kuo, host of the Sinica podcast at supchina.com, who recently returned to the U.S after 20 years in Beijing—the last six as director of international communications for the tech giant Baidu. Like some other veteran China-watchers, Kuo believes neither extreme reflects reality. "We're in as much danger now of overestimating China's innovative capacity," he warns, "as we were a few years ago of underestimating it."

A Lab and Tech-Business Bonanza

By many measures, China's innovation renaissance is mind-boggling. Spending on research and development as a percentage of gross domestic product nearly quadrupled between 1996 and 2016, from .56 percent to 2.1 percent; during the same period, spending in the United States rose by just .3 percentage points, from 2.44 to 2.79 percent of GDP. China is now second only to the U.S. in total R&D spending, accounting for 21 percent of the global total of $2 trillion, according to a report released in January by the National Science Foundation. In 2016, the number of scientific publications from China exceeded those from the U.S. for the first time, by 426,000 to 409,000. Chinese researchers are blazing new trails on the frontiers of cloning, stem cell medicine, gene editing, and quantum computing. Chinese patent applications have soared from 170,000 to nearly 3 million since 2000; the country now files almost as many international patents as the U.S. and Japan, and more than Germany and South Korea. Between 2008 and 2017, two Chinese tech firms—Huawei and ZTE—traded places as the world's top patent filer in six out of nine years.

"China is still in its Star Trek phase, while we're in our Black Mirror phase." Yet there are formidable barriers to China beating America in the innovation race—or even catching up anytime soon.

Accompanying this lab-based ferment is a tech-business bonanza. China's three biggest internet companies, Baidu, Alibaba Group and Tencent Holdings (known collectively as BAT), have become global titans of search, e-commerce, mobile payments, gaming, and social media. Da-Jiang Innovations in Science and Technology (DJI) controls more than 70 percent of the world's commercial drone market. Of the planet's 262 "unicorns" (startups worth more than a billion dollars), about one-third are Chinese. The country attracted $77 billion in venture capital investment between 2014 and 2016, according to Fortune, and is now among the top three markets for VC in emerging technologies including AI, virtual reality, autonomous vehicles, and 3D printing.

These developments have fueled a buoyant techno-optimism in China that contrasts sharply with the darker view increasingly prevalent in the West—in part, perhaps, because China's historic limits on civil liberties have inured the populace to the intrusive implications of, say, facial recognition technology or social-credit software, which are already being used to tighten government control. "China is still in its Star Trek phase, while we're in our Black Mirror phase," Kuo observes. By contrast with Americans' ambivalent attitudes toward Facebook founder Mark Zuckerberg or Amazon's Jeff Bezos, he adds, most Chinese regard tech entrepreneurs like Baidu's Robin Li and Alibaba's Jack Ma as "flat-out heroes."

Yet there are formidable barriers to China beating America in the innovation race—or even catching up anytime soon. Many are catalogued in The Fat Tech Dragon, a 2017 monograph by Scott Kennedy, deputy director of the Freeman Chair in China Studies and director of the Project on Chinese Business and Political Economy at the Center for Strategic and International Studies. Among the obstacles, Kennedy writes, are "an education system that encourages deference to authority and does not prepare students to be creative and take risks, a financial system that disproportionately funnels funds to undeserving state-owned enterprises… and a market structure where profits can be made through a low-margin, high-volume strategy or through political connections."

China's R&D money, Kennedy points out, is mostly showered on the "D": of the $209 billion spent in 2015, only 5 percent went toward basic research, 10.8 percent toward applied research, and a massive 84.2 percent toward development. While fully half of venture capital in the States goes to early-stage startups, the figure for China is under 20 percent; true "angel" investors are scarce. Likewise, only 21 percent of Chinese patents are for original inventions, as opposed to tweaks of existing technologies. Most problematic, the domestic value of patents in China is strikingly low. In 2015, the country's patent licensing generated revenues of just $1.75 billion, compared to $115 billion for IP licensing in the U.S. in 2012 (the most recent year for which data is available). In short, Kennedy concludes, "China may now be a 'large' IP country, but it is still a 'weak' one."

"[The Chinese] are trying very hard to keep the economy from crashing, but it'll happen eventually. Then there will be a major, major contraction."

Anne Stevenson-Yang, co-founder and research director of J Capital Research, and a leading China analyst, sees another potential stumbling block: the government's obsession with neck-snapping GDP growth. "What China does is to determine, 'Our GDP growth will be X,' and then it generates enough investment to create X," Stevenson-Yang explains. To meet those quotas, officials pour money into gigantic construction projects, creating the empty "ghost cities" that litter the countryside, or subsidize industrial production far beyond realistic demand. "It's the ultimate Ponzi-scheme economy," she says, citing as examples the Chinese cellphone and solar industries, which ballooned on state funding, flooded global markets with dirt-cheap products, thrived just long enough to kill off most of their overseas competitors, and then largely collapsed. Such ventures, Stevenson-Yang notes, have driven China's debt load perilously high. "They're trying very hard to keep the economy from crashing, but it'll happen eventually," she predicts. "Then there will be a major, major contraction."

"An Intensifying Race Toward Techno-Nationalism"

The greatest vulnerability of the Chinese innovation boom may be that it still depends heavily on imported IP. "Over the last few years, China has placed its bets on a combination of global knowledge sourcing and indigenous technology development," says Dieter Ernst, a senior fellow at the Centre for International Governance Innovation in Waterloo, Canada, and theEast-West Center in Honolulu, who has served as an Asia advisor for the U.N. and the World Bank. Aside from international journals (and, occasionally, industrial espionage), Chinese labs and corporations obtain non-indigenous knowledge in a number of ways: by paying licensing fees; recruiting Chinese scientists and engineers who've studied or worked abroad; hiring professionals from other countries; or acquiring foreign companies. And though enforcement of IP laws has improved markedly in recent years, foreign businesses are often pressured to provide technology transfers in exchange for access to markets.

Many of China's top tech entrepreneurs—including Ma, Li, and Alibaba's Joseph Tsai—are alumni of U.S. universities, and, as Kuo puts it, "big fans of all things American." Unfortunately, however, Americans are ever less likely to be fans of China, thanks largely to that country's sometimes predatory trade practices—and also to what Ernst calls "an intensifying race toward techno-nationalism." With varying degrees of bellicosity and consistency, leaders of both U.S. parties embrace elements of the trend, as do politicians (and voters) across much of Europe. "There's a growing consensus that China is poised to overtake us," says Ernst, "and that we need to design policies to obstruct its rise."

One of the foremost liberal analysts supporting this view is Lee Branstetter, a professor of economics and public policy at Carnegie Mellon University and former senior economist on President Barack Obama's Council of Economic Advisors. "Over the decades, in a systematic and premeditated fashion, the Chinese government and its state-owned enterprises have worked to extract valuable technology from foreign multinationals, with an explicit goal of eventually displacing those leading multinationals with successful Chinese firms in global markets," Branstetter wrote in a 2017 report to the United States Trade Representative. To combat such "forced transfers," he suggested, laws could be passed empowering foreign governments to investigate coercive requests and block any deemed inappropriate—not just those involving military-related or crucial infrastructure technology, which current statutes cover. Branstetter also called for "sharply" curtailing Chinese students' access to Western graduate programs, as a way to "get policymakers' attention in Beijing" and induce them to play fair.

Similar sentiments are taking hold in Congress, where the Foreign Investment Risk Review Modernization Act—aimed at strengthening the process by which the Committee on Foreign Investment in the United States reviews Chinese acquisition of American technologies—is expected to pass with bipartisan support, though its harsher provisions were softened due to objections from Silicon Valley. The Trump Administration announced in May that it would soon take executive action to curb Chinese investments in U.S. tech firms and otherwise limit access to intellectual property. The State Department, meanwhile, imposed a one-year limit on visas for Chinese grad students in high-tech fields.

Ernst argues that such measures are motivated largely by exaggerated notions of China's ability to reach its ambitious goals, and by the political advantages that fearmongering confers. "If you look at AI, chip design and fabrication, robotics, pharmaceuticals, the gap with the U.S. is huge," he says. "Reducing it will take at least 10 or 15 years."

Cracking down on U.S. tech transfers to Chinese companies, Ernst cautions, will deprive U.S. firms of vital investment capital and spur China to retaliate, cutting off access to the nation's gargantuan markets; it will also push China to forge IP deals with more compliant nations, or revert to outright piracy. And restricting student visas, besides harming U.S. universities that depend on Chinese scholars' billions in tuition, will have a "chilling effect on America's ability to attract to researchers and engineers from all countries."

"It's not a zero-sum game. I don't think China is going to eat our lunch. We can sit down and enjoy lunch together."

America's own science and technology community, Ernst adds, considers it crucial to swap ideas with China's fast-growing pool of talent. The 2017 annual meeting of the Palo Alto-based Association for Advancement of Artificial Intelligence, he notes, featured a nearly equal number of papers by researchers in China and the U.S. Organizers postponed the meeting after discovering that the original date coincided with the Chinese New Year.

China's rising influence on the tech world carries upsides as well as downsides, Scott Kennedy observes. The country's successes in e-commerce, he says, "haven't damaged the global internet sector, but have actually been a spur to additional innovation and progress. By contrast, China's success in solar and wind has decimated the global sectors," due to state-mandated overcapacity. "When Chinese firms win through open competition, the outcome is constructive; when they win through industrial policy and protectionism, the outcome is destructive."

The solution, Kennedy and like-minded experts argue, is to discourage protectionism rather than engage in it, adjusting tech-transfer policy just enough to cope with evolving national-security concerns. Instead of trying to squelch China's innovation explosion, they say, the U.S. should seek ways to spread its potential benefits (as happened in previous eras with Japan and South Korea), and increase America's indigenous investments in tech-related research, education, and job training.

"It's not a zero-sum game," says Kaiser Kuo. "I don't think China is going to eat our lunch. We can sit down and enjoy lunch together."

Thanks to safety cautions from the COVID-19 pandemic, a strain of influenza has been completely eliminated.

If you were one of the millions who masked up, washed your hands thoroughly and socially distanced, pat yourself on the back—you may have helped change the course of human history.

Scientists say that thanks to these safety precautions, which were introduced in early 2020 as a way to stop transmission of the novel COVID-19 virus, a strain of influenza has been completely eliminated. This marks the first time in human history that a virus has been wiped out through non-pharmaceutical interventions, such as vaccines.

The flu shot, explained

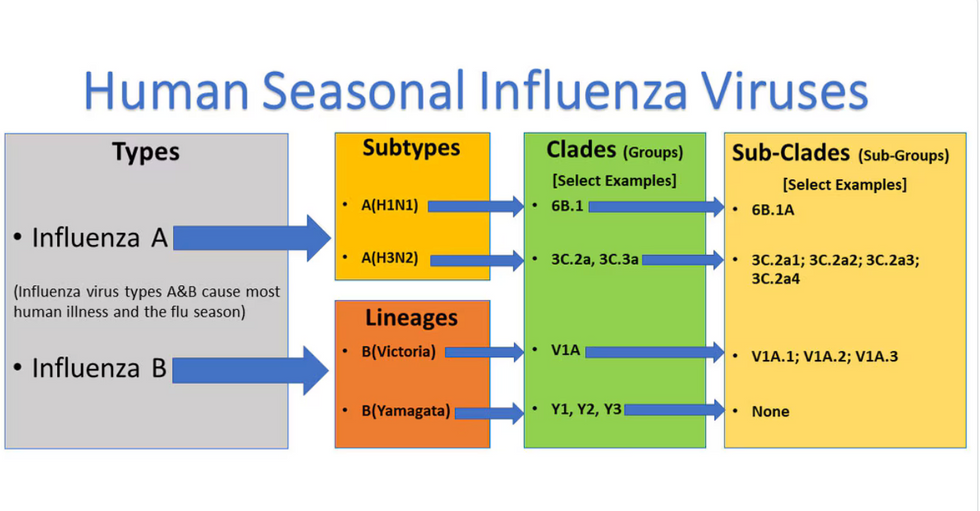

Influenza viruses type A and B are responsible for the majority of human illnesses and the flu season.

Centers for Disease Control

For more than a decade, flu shots have protected against two types of the influenza virus–type A and type B. While there are four different strains of influenza in existence (A, B, C, and D), only strains A, B, and C are capable of infecting humans, and only A and B cause pandemics. In other words, if you catch the flu during flu season, you’re most likely sick with flu type A or B.

Flu vaccines contain inactivated—or dead—influenza virus. These inactivated viruses can’t cause sickness in humans, but when administered as part of a vaccine, they teach a person’s immune system to recognize and kill those viruses when they’re encountered in the wild.

Each spring, a panel of experts gives a recommendation to the US Food and Drug Administration on which strains of each flu type to include in that year’s flu vaccine, depending on what surveillance data says is circulating and what they believe is likely to cause the most illness during the upcoming flu season. For the past decade, Americans have had access to vaccines that provide protection against two strains of influenza A and two lineages of influenza B, known as the Victoria lineage and the Yamagata lineage. But this year, the seasonal flu shot won’t include the Yamagata strain, because the Yamagata strain is no longer circulating among humans.

How Yamagata Disappeared

Flu surveillance data from the Global Initiative on Sharing All Influenza Data (GISAID) shows that the Yamagata lineage of flu type B has not been sequenced since April 2020.

Nature

Experts believe that the Yamagata lineage had already been in decline before the pandemic hit, likely because the strain was naturally less capable of infecting large numbers of people compared to the other strains. When the COVID-19 pandemic hit, the resulting safety precautions such as social distancing, isolating, hand-washing, and masking were enough to drive the virus into extinction completely.

Because the strain hasn’t been circulating since 2020, the FDA elected to remove the Yamagata strain from the seasonal flu vaccine. This will mark the first time since 2012 that the annual flu shot will be trivalent (three-component) rather than quadrivalent (four-component).

Should I still get the flu shot?

The flu shot will protect against fewer strains this year—but that doesn’t mean we should skip it. Influenza places a substantial health burden on the United States every year, responsible for hundreds of thousands of hospitalizations and tens of thousands of deaths. The flu shot has been shown to prevent millions of illnesses each year (more than six million during the 2022-2023 season). And while it’s still possible to catch the flu after getting the flu shot, studies show that people are far less likely to be hospitalized or die when they’re vaccinated.

Another unexpected benefit of dropping the Yamagata strain from the seasonal vaccine? This will possibly make production of the flu vaccine faster, and enable manufacturers to make more vaccines, helping countries who have a flu vaccine shortage and potentially saving millions more lives.

After his grandmother’s dementia diagnosis, one man invented a snack to keep her healthy and hydrated.

Founder Lewis Hornby and his grandmother Pat, sampling Jelly Drops—an edible gummy containing water and life-saving electrolytes.

On a visit to his grandmother’s nursing home in 2016, college student Lewis Hornby made a shocking discovery: Dehydration is a common (and dangerous) problem among seniors—especially those that are diagnosed with dementia.

Hornby’s grandmother, Pat, had always had difficulty keeping up her water intake as she got older, a common issue with seniors. As we age, our body composition changes, and we naturally hold less water than younger adults or children, so it’s easier to become dehydrated quickly if those fluids aren’t replenished. What’s more, our thirst signals diminish naturally as we age as well—meaning our body is not as good as it once was in letting us know that we need to rehydrate. This often creates a perfect storm that commonly leads to dehydration. In Pat’s case, her dehydration was so severe she nearly died.

When Lewis Hornby visited his grandmother at her nursing home afterward, he learned that dehydration especially affects people with dementia, as they often don’t feel thirst cues at all, or may not recognize how to use cups correctly. But while dementia patients often don’t remember to drink water, it seemed to Hornby that they had less problem remembering to eat, particularly candy.

Hornby wanted to create a solution for elderly people who struggled keeping their fluid intake up. He spent the next eighteen months researching and designing a solution and securing funding for his project. In 2019, Hornby won a sizable grant from the Alzheimer’s Society, a UK-based care and research charity for people with dementia and their caregivers. Together, through the charity’s Accelerator Program, they created a bite-sized, sugar-free, edible jelly drop that looked and tasted like candy. The candy, called Jelly Drops, contained 95% water and electrolytes—important minerals that are often lost during dehydration. The final product launched in 2020—and was an immediate success. The drops were able to provide extra hydration to the elderly, as well as help keep dementia patients safe, since dehydration commonly leads to confusion, hospitalization, and sometimes even death.

Not only did Jelly Drops quickly become a favorite snack among dementia patients in the UK, but they were able to provide an additional boost of hydration to hospital workers during the pandemic. In NHS coronavirus hospital wards, patients infected with the virus were regularly given Jelly Drops to keep their fluid levels normal—and staff members snacked on them as well, since long shifts and personal protective equipment (PPE) they were required to wear often left them feeling parched.

In April 2022, Jelly Drops launched in the United States. The company continues to donate 1% of its profits to help fund Alzheimer’s research.